Fixing life insurance

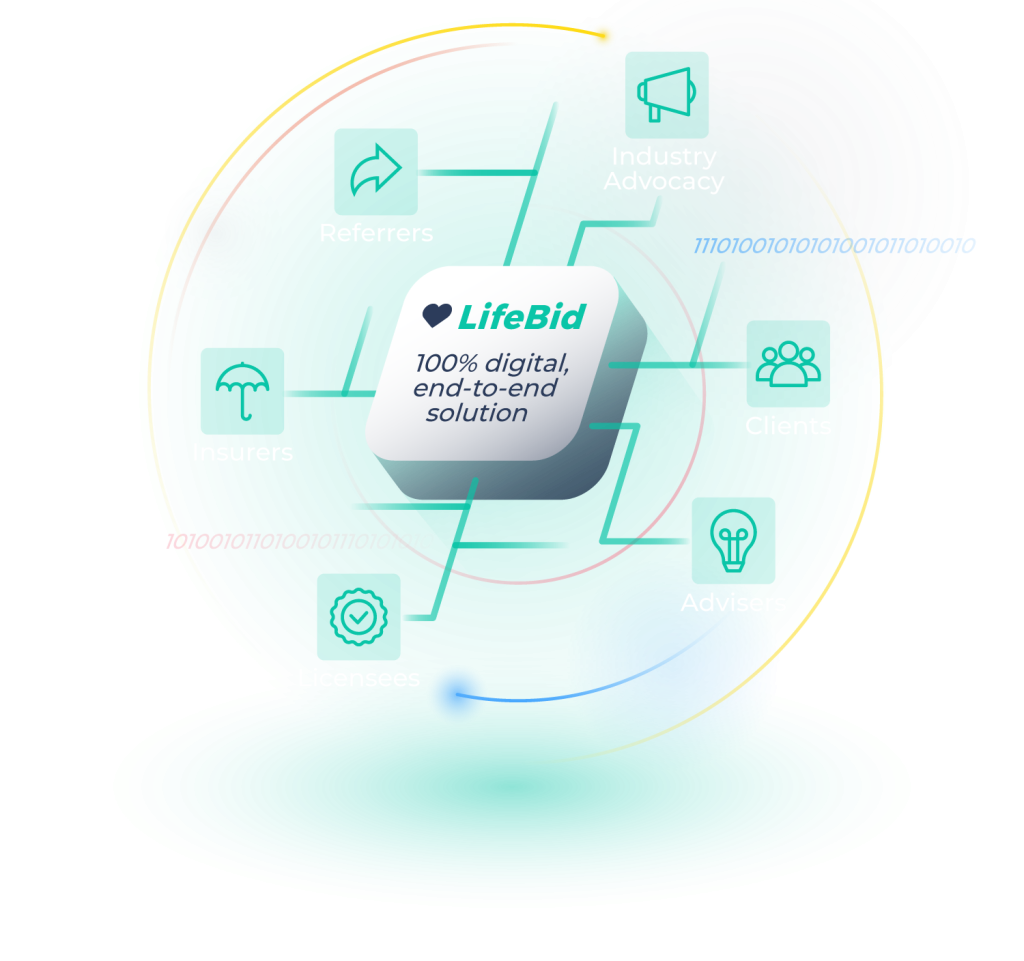

LifeBid is working to reduce costs to serve by up to 90%, so advisers and insurers can 10x their life insurance advice, ongoing service and distribution capabilities; whilst providing easy, affordable access to quality advice and cover, for all Australians.

From referrals and new advice, to renewals, policy alerts and claims, you will be able to do it all in one platform, both simply and profitably.

LifeBid is working to reduce costs to serve by up to 90%, so advisers and insurers can 10x their life insurance advice, ongoing service and distribution capabilities; whilst providing easy, affordable access to quality advice and cover, for all Australians.

From referrals and new advice, to renewals, policy alerts and claims, you will be able to do it all in one platform, both simply and profitably.

LifeBid is supported by our industry’s most innovative leaders

Platinum Insurers

Gold Insurers

Foundation Advice Partners

Advocacy Partners

The Problem

- It has become unaffordable and too hard for everyday Australians to access good quality life insurance advice and cover.

- Advice providers and insurers are struggling, because costs to serve, complexity and compliance risks, have simply become too high.

- Consumers needs are going unmet, and advisers are opting out of providing life insurance advice, or worse, they are choosing to leave the industry all together.

- Life insurance and advice matters, because it helps us protect our incomes, care for our loved ones and leave legacies, not debts, which is why it is critical we solve the industry’s problems at an industry level – to ensure advised life insurance survives and thrives.

Introducing LifeBid

Whether you are a life risk specialist or a holistic financial adviser, you will be able to use LifeBid to profitably meet your clients life insurance needs, significantly reduce your regulatory risks and enable the exponential growth of your risk advice offerings.

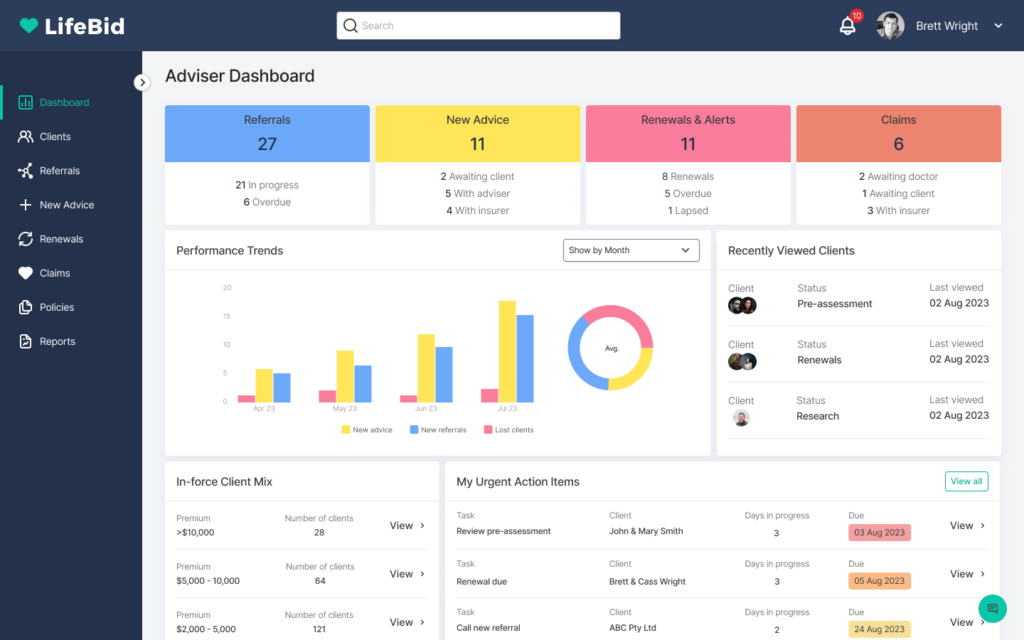

New Advice.

Reduce cost to serve by up to 90%, and 10x advice capability.

Educate, scope, fact find, analyse needs, research, pre-assess and issue advice ready for implementation, in the one platform.

Renewals & alerts.

No more manual and clunky renewal management.

Prepare renewal packs, issue review offers, connect with clients, resell the value and need of cover and increase retention, with a few clicks.

Referrals.

Make life easy for referral partners.

Increase quality referrals, by simplifying the client engagement, education and referral process for your accounting, mortgage, general insurance and legal partners.

Claims.

Deliver on the promise quickly and efficiently.

Manage claims requirements with insurers, doctors and your clients seamlessly, to save time and avoid stress when your clients need your support the most.

We are supporting LifeBid because…

Adviser advocacy.

It’s time to showcase the great work advisers and insurers do for our communities and the economy, working hard to ensure Australian’s, their families and businesses are protected. LifeBid is getting the message out there.

Flawless

client-adviser experience.

Compliant

simplicity.

Providing life insurance advice should not be a compliance nightmare, spread across multiple siloed systems, processes and pieces of software. LifeBid is working with industry to ensure advisers can seamlessly help as many clients as possible, using one system and without fear of non-compliance.

Stay in the know.

Register your interest and stay up to date with LifeBid news and announcements.